Universal Credit

Get to know more about your eligibility before applying for Universal Credit

If you already get other benefits

Universal Credit is replacing the following benefits:

- Child Tax Credit

- Housing Benefit

- Income Support

- income-based Jobseeker’s Allowance (JSA)

- income-related Employment and Support Allowance (ESA)

- Working Tax Credit

If you currently get any of these benefits, you do not need to do anything unless:

- you have a change of circumstances you need to report

Eligibility

You may be able to get Universal Credit if:

- you’re on a low income or out of work

- you’re 18 or over (there are some exceptions if you’re 16 to 17)

- you’re under State Pension age (or your partner is)

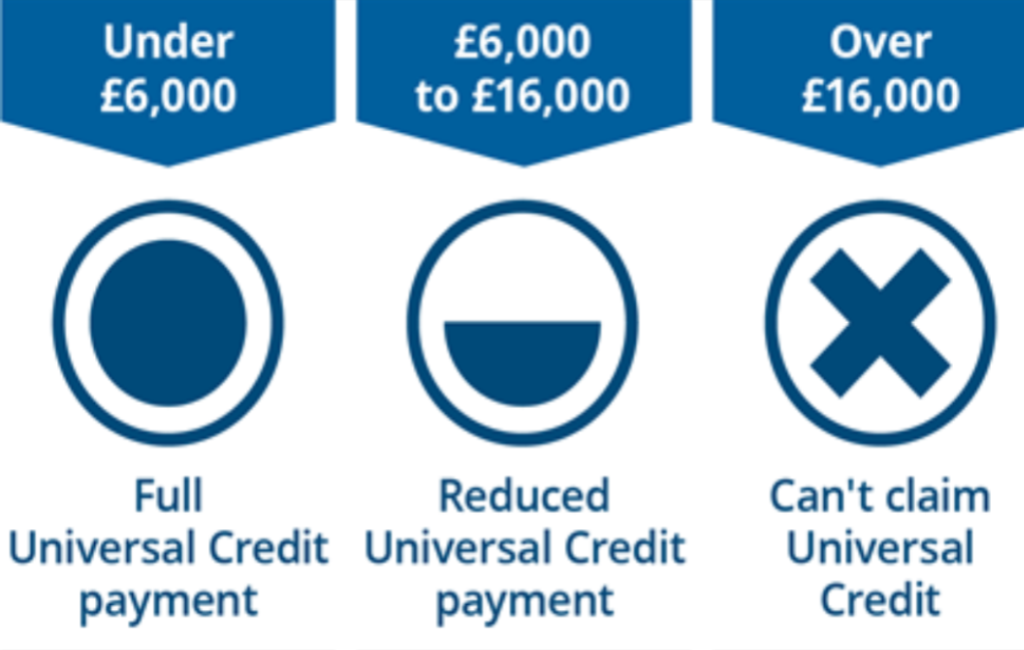

- you and your partner have £16,000 or less in savings between you

- you live in the UK

The number of children you have does not affect your eligibility for Universal Credit, but it may affect how much you get.

If you live with your partner

Your partner’s income and savings will be taken into account, even if they are not eligible for Universal Credit.

If you’re 16 or 17

You can make a new claim for Universal Credit if any of the following apply:

- you have medical evidence and are waiting for a Work Capability Assessment

- you’re caring for a severely disabled person

- you’re responsible for a child

- you’re in a couple with responsibility for at least one child and your partner is eligible for Universal Credit

- you’re pregnant and it’s 11 weeks or less before your expected week of childbirth

- you’ve had a child in the last 15 weeks

- you do not have parental support, for example you’re estranged from your parents and you’re not under local authority care.

If you’re studying full-time

You can also make a claim if you’re in full-time further education and any of the following apply:

- you do not have parental support and you’re not under local authority care

- you have limited capability for work and you’re entitled to Personal Independence Payment (PIP) or Disability Living Allowance (DLA)

- you’re responsible for a child

- you’re in a couple with responsibility for a child and your partner is eligible for Universal Credit

If you’re 18 or over and in training or studying full-time

You can make a new claim for Universal Credit if any of the following apply:

- you live with your partner and they’re eligible for Universal Credit

- you’re responsible for a child, either as a single person or as a couple

- you’re in further education, are 21 or under and do not have parental support, for example you’re estranged from your parents and you’re not under local authority care

If you’re moving from Employment and Support Allowance (ESA)

You can make a new claim for Universal Credit if you’re in full-time education and all of the following apply:

- you’re entitled to Personal Independence Payment (PIP) or Disability Living Allowance (DLA)

- you’ve already been assessed as having limited capability for work

you make a new claim before your ESA ends or as soon as you’re notified that your ESA claim has ended.

Extra amounts

You may get more money on top of your standard allowance if you’re eligible.

If you have children

If you have 1 or 2 children, you’ll get an extra amount for each child.

If you have 3 or more children, you’ll get an extra amount for at least 2 children. You can only get an extra amount for more children if any of the following are true:

- your children were born before 6 April 2017

- you were already claiming for 3 or more children before 6 April 2017.

- Multiple Birth

- Adopted children

You’ll get an extra amount for any disabled or severely disabled child – no matter how many children you have or when they were born.

How much you’ll get | Extra monthly amount |

For your first child | £282.50 (born before 6 April 2017) |

For your second child and any other eligible children | £237.08 per child |

If you have a disabled or severely disabled child | £128.89 or £402.41 |

If you need help with childcare costs | up to 85% of your costs (up to £646.35 for one child and £1,108.04 for 2 or more children) |

You might get the extra amount if you start caring for another child, depending on when they were born and how many children you have.

If you have a disability or health condition

How much you’ll get | Extra monthly amount |

If you have limited capability for work and work-related activity | £343.63 |

If you have limited capability for work and you started your health-related Universal Credit or Employment and Support Allowance (ESA) claim before 3 April 2017 | £128.89 |

If you care for a severely disabled person

How much you’ll get | Extra monthly amount |

If you provide care for at least 35 hours a week for a severely disabled person who receives a disability-related benefit | £163.73 |

This is on top of any extra amount you get if you have a disabled child.

Housing costs

You could get money to help pay your housing costs. How much you get depends on your age and circumstances.

The payment can cover rent and some service charges.

If you’re a homeowner, you might be able to get a loan to help with interest payments on your mortgage or other loans you’ve taken out for your home.

We will ask ask you for:

- your email address

- your telephone number.

- your postcode

- your National Insurance number

- proof of your nationality

- your housing details

- details about people who live with you – such as your partner, children you are responsible for, or lodgers

- Child Benefit reference numbers, if you receive Child Benefit

- employer details, if you or your partner are working

- etails about any earnings or other income you or your partner have

- details of any savings, investments or other capital you or your partner have

- details of any other benefits you receive

- information about your health

- details of the account your payments will go into, such as a bank, building society or credit union account. This will need to be a current account, not a savings account, and should be in your name.